Ensuring Bids for ALL Eligible Locations in BEAD: The Challenge Ahead

Tuesday, December 12, 2023

Digital Beat

Ensuring Bids for ALL Eligible Locations in BEAD: The Challenge Ahead

States are racing to finish their Initial Proposals for the National Telecommunications and Information Administration's $40+ billion Broadband Equity Access and Deployment (BEAD) program. One of the things they need to be thinking about is how to design their programs so that they have viable applicants for all their eligible locations, not just most of them. This requires a radical shift in mindset from past grantmaking activities, when the state’s task was to award grants to improve service in discrete areas.

NTIA has said time and time again, the Administration’s goal is to bring high-speed reliable internet to all. 95% coverage is not an A—it’s a failure. States like Colorado and Texas have discovered in prior funding programs that some geographies eligible for awards received no applications. That’s a problem that has to be solved.

Why is this likely to be a problem?

Congress mandated that the first funding priority is to bring service to all unserved locations (those lacking 25/3 Mbps service), the second priority is underserved locations (those lacking 100/20 Mbps service), and the third priority is community anchor institutions. If there is any remaining funding, it can be used for permitted non-deployment activities.

Each state must demonstrate to NTIA that it will be awarding funding to subgrantees consistent with this prioritization scheme. NTIA has made clear that it is not requiring states to first conduct a grant process for unserved projects, followed by a separate grant round for underserved projects—but it does expect an explanation of how the state will meet the statutory requirements. States that fail to explain to NTIA’s satisfaction how they will meet this prioritization scheme run the risk that NTIA will delay approval and release of their allotted funding.

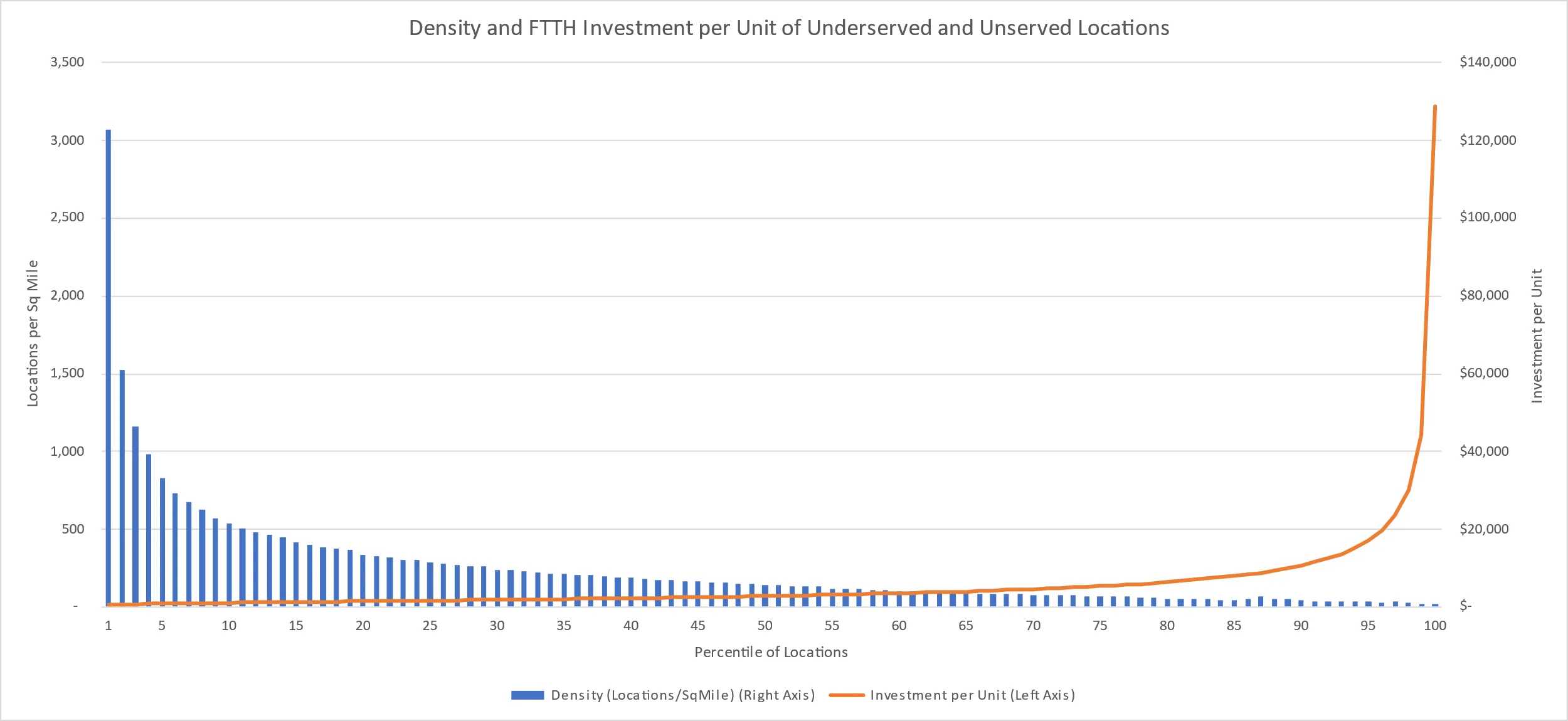

Focusing only on the average amount of funding allocated per eligible location in a state to do a back of the envelope calculation of whether a state has enough money to cover all of its unserved and underserved locations misses the point: in many states, there are going to be some exceptionally costly locations to serve, where the cost to deploy fiber is way above the average. CostQuest projects that deploying fiber to very low density locations can exceed $100,000 per unit.

Those are the locations that could bust the state’s allotted BEAD budget. That’s why there’s an Extremely High Cost Per Location Threshold, which determines where states are allowed to select alternative technologies over fiber. (More on that in a future article . . .)

To illustrate with a real world example—USDA recently announced $25 million ReConnect Round IV award for a fiber project to serve 36 households. When I first did the math, I thought I’d made a mistake on my calculator.

Applicant: Big Bend Telephone Company, Inc.

Location: Texas

Total Square Miles: 52.2

Funded Service Area Households: 36

Award Amount: $25,000,000

This Rural Development investment will be used to deploy a fiber-to-the-premises network to provide high-speed internet. This network will benefit 64 people, one business and eight farms in Terrell, Val Verde and Brewster counties in Texas.

That’s a whopping $699,444 average cost per house! Given the size of the funded service area, it’s definitely a low-density project.

According to the awardee’s website, 218 households will be served, which brings the cost down to a mere $114,678 per home. But what caught my eye is the project will add over 272 miles of fiber to these rural counties. Not only are there few homes to be served, but you need a lot of fiber just to reach them.

Similar stories are emerging from multiple states. The Oklahoma Broadband Office noted at the recent US Broadband Summit in Washington (DC) that it was quoted a price of $118,000/passing to extend fiber to locations in one part of the state. The Kentucky Broadband Office said there are locations in the state where the cost to deploy fiber is estimated to be over $100,000 per passing.

Who’s coming to the rescue?

The publicly traded, larger broadband providers and private equity-backed players are not going to pursue the highest cost to serve locations; they want to keep their capex per passing to a much lower level. While historically wireless internet service providers have gravitated to the markets that others have left behind, they too may find the economics unpalatable for the highest cost to serve locations. Some of these locations will be in areas where the geography is challenging, even for fixed wireless. While community-based service providers, including cooperatives, will have a greater personal stake in bringing service to everyone, not all areas will have a community-based entity ready, willing and able to get the job done. For some locations, satellite may be the only option.

So, what tools do states have to ensure 100% coverage?

Solicit interest from potential applicants before requesting applications: Some states like Michigan, Mississippi and North Dakota plan to ask prospective applicants to identify potential project areas of interest before formally opening the application process. One issue is whether service providers will indicate interest for all areas in the state, to preserve their options, thereby obscuring where they are most likely to seek funding.

Work to reduce the number of “unserved” broadband serviceable locations in the state: After the race earlier this year to get locations “added” to the Federal Communications Commission’s National Broadband Map, some states are beginning to realize that was a double-edged sword — because now they have to show NTIA they have a plan to get service to all of those locations. States aren’t allowed to remove those locations in their state-run challenge process: the only way they can get rid of any off-road, off-the-grid structures like hunting cabins in the woods is to challenge those locations at the FCC.

State-defined service areas: A number of states are planning to require applicants to bid on state-determined project areas, such as counties (Georgia), Zip Code Tabulation Areas (Virginia), or Unified School Districts (Kansas), with the expectation that applicants must commit to 100% coverage for the pre-defined project areas. While this approach obviates the need to address overlapping project boundaries, project areas based on governmental boundaries may or may not make sense for project economics. Those with existing plant in much of the pre-defined area presumably would have an inherent advantage in bidding for such areas. Smaller service providers that don’t want to serve the entirety of a larger pre-defined area will have to decide whether it’s worth it to bid on the whole area in order to get funding for the part they actually want to serve. Alternatively, smaller providers could seek partnerships with others interested in portions of the pre-defined area.

Some states like Oklahoma are planning to put their pre-defined project areas (“Network Expansion Territories”) out for public comment before finalizing so service providers can indicate whether the boundaries should be adjusted. Again, one concern is that prospective service providers do not necessarily have incentives to preview their intentions in a public process.

Multiple grant rounds: A number of states intend to solicit multiple rounds of applications, with the hope that successive rounds will elicit support for areas that fail to receive interest in the first round. Oklahoma intends to keep its underserved area awards tentative until the unserved area broadband coverage gap has been fully addressed.

Negotiation with service providers after applications are submitted: States must conduct a competitive grant process, but only one competitive round is required. If, after soliciting proposals, the state receives no proposals to serve particular locations or group of locations that are unserved, underserved, or a combination unserved and underserved, NTIA will allow them to reach out to existing providers and/or other prospective subgrantees to find providers willing to expand their existing or proposed service areas. The question remains, however, whether procurement requirements in some states will permit this sort of ad hoc negotiation.

Alternative technologies: NTIA will allow awards to entities that do not meet its definition of reliable broadband if there are no other options. Even the most pro-fiber states in the country are beginning to realize they can’t slam the door on alternative technologies to fill in the gaps. There’s a common assumption that for some limited subset of locations, satellite may be the answer, but what if satellite does not show up for the party? Will satellite providers like Starlink even apply for BEAD funding in states where they expect they’ll win funding to serve only a small number of locations? Will states be willing — or even legally permitted — to effectively serve as the middleman for a satellite bulk purchasing arrangement to lessen the transaction costs for satellite as an alternative? Would states instead prefer to use BEAD funding to provide vouchers to consumers that reside at locations that receive no bids to defray the cost of satellite installation and monthly service for a period of time?

The amount of BEAD funding appropriated by Congress looks to be insufficient to incent the private sector to build fiber everywhere in every state and territory in the nation. States are going to have to make some tough choices to make sure that they have viable bidders for all their eligible locations. It’s time to shift from a grantmaking mindset to a focus on universal service.

This article originally appeared on Medium; it is reprinted here with permission of the author.

Carol Mattey is a former senior official from the Federal Communications Commission, where she led teams working on initiatives to modernize the FCC’s $9 billion Universal Service Fund to support broadband. She currently is the principal of Mattey Consulting LLC, which provides strategic and public policy advisory services to broadband providers and other entities seeking funding for broadband. She is partnering with Irby Utilities to help achieve the vision of bringing sustainable, reliable internet to everyone in rural America.

The Benton Institute for Broadband & Society is a non-profit organization dedicated to ensuring that all people in the U.S. have access to competitive, High-Performance Broadband regardless of where they live or who they are. We believe communication policy - rooted in the values of access, equity, and diversity - has the power to deliver new opportunities and strengthen communities.

© Benton Institute for Broadband & Society 2023. Redistribution of this email publication - both internally and externally - is encouraged if it includes this copyright statement.

For subscribe/unsubscribe info, please email headlinesATbentonDOTorg